Bank Vs Mortgage Broker

In the past, home buyers exclusively turned to their banks for their mortgage needs. Today, if you are looking for a mortgage on a new purchase or renewing the mortgage on a home you already own, you have the option to choose a mortgage broker as well. While considering looking for a mortgage for your home, it is important to understand the differences between banks and mortgage brokers and what each can uniquely offer. The main difference is that the bank represents only the products that their institution offers, whereas mortgage brokers work with multiple lenders and have access to more options with different and sometimes better rates and mortgage terms. While the majority home owners still use traditional banks for their mortgage needs, the use of brokers has been increasing. This increasing rate has been seen mostly in first-time home buyers. This demographic of buyers generally looks to find the best deal and the best rate on the market. This is the main reason why they prefer the convenience of a mortgage broker and the options they can bring.

Since mortgage brokers work with multiple lenders which include major banks, smaller lenders, credit corporations, insurance and trust companies and even private lenders, they often have access to the best rates on the market. In 2017, nearly 40% of homeowners interacted with a mortgage broker. This saw an increase from 33% in 2016, according to CMHC. There have been several changes in the last 24 months regarding mortgage regulations, policies and the entire interest rate environment. This has made the entire experience and understanding of a mortgage more complicated. Mortgage Brokers understand these changes and constantly study new regulations and give you expert advice and guidance through the entire mortgage process.

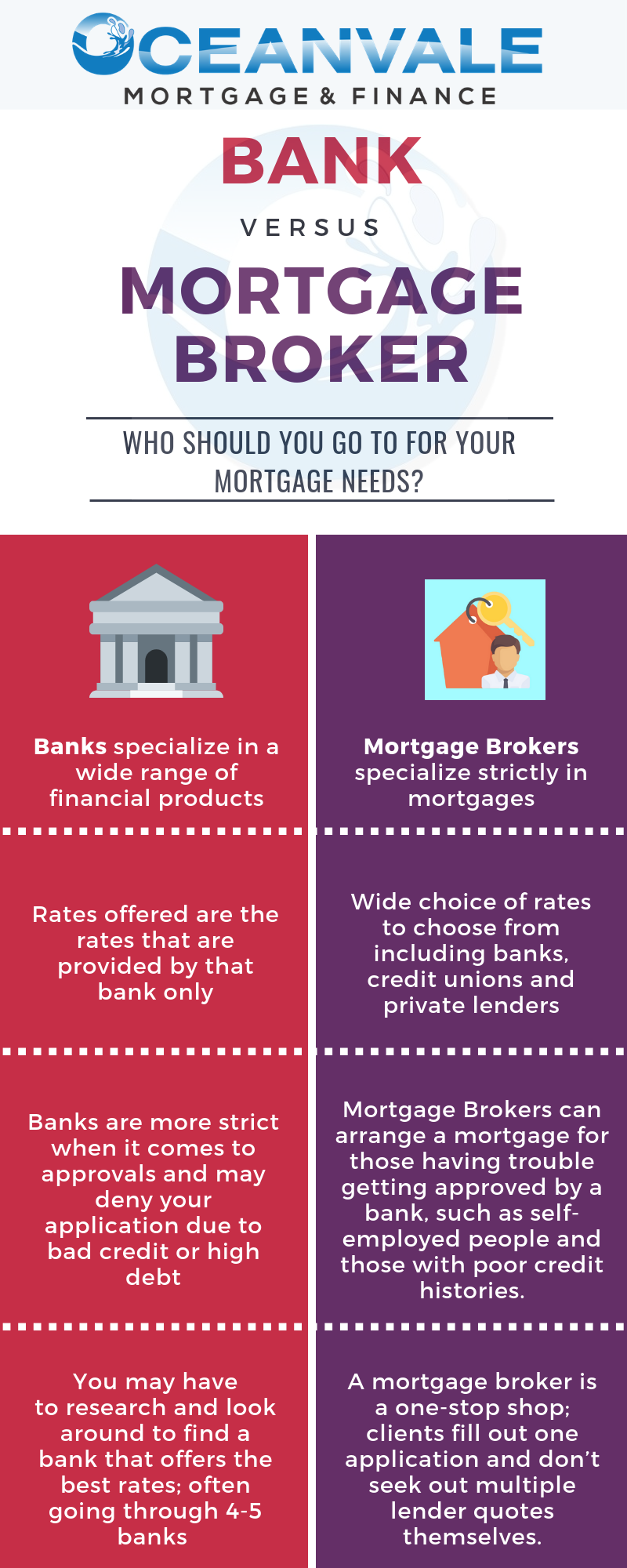

Some of the differences between Mortgage Brokers and Banks can be seen below:

If you choose to go with a bank or a mortgage broker, the down payment rules still stay the same. You will have to be able to put 5% down for a house priced less than $500,000. If your purchase price is between $500,000 and $999,999, you will have to put 5% down for the first $500,000 and 10% for the amount over $500,000. If the property you are purchasing is $1 million and above, you will need to put 20% down. Further, all down payments less than 20% require you to have a mortgage insurance.

A mortgage broker can discuss with you about your personal, financial and lifestyle situation. You can tell them your future plans in regard to your home, whether you want to stay in it for a long time or move in a few years. A mortgage broker can then note these requirements and based on your profile, advice you with the best solutions which will be financially beneficial for you. They can also provide details on various lenders, discuss with you the pros and cons of fixed verses variable rate and point out cancellation and pre-payment policies. This expertise provided by a mortgage broker can help you understand your mortgage, giving you a mortgage clarity that a bank might not always provide. Mortgage Brokers can advise which lenders will consider your case and which will not be based on your individual circumstances. This is particularly useful for people with poor credit ratings. Mortgage brokers have access to lenders who specialize in servicing people with adverse credit and can leverage relationships with mainstream banks. They can also access exclusive deals not available on the open market or negotiate a better interest rate or lower application fees from the lender in some cases.

Oceanvale Mortgage & Finance is such a mortgage brokerage which specializes in getting our clients the best rates and terms on their mortgages all while delivering exquisite customer service throughout to ensure you a hassle-free mortgage experience. Reach out to us to find out how we can beat the bank rates on your mortgage or on your upcoming renewal.